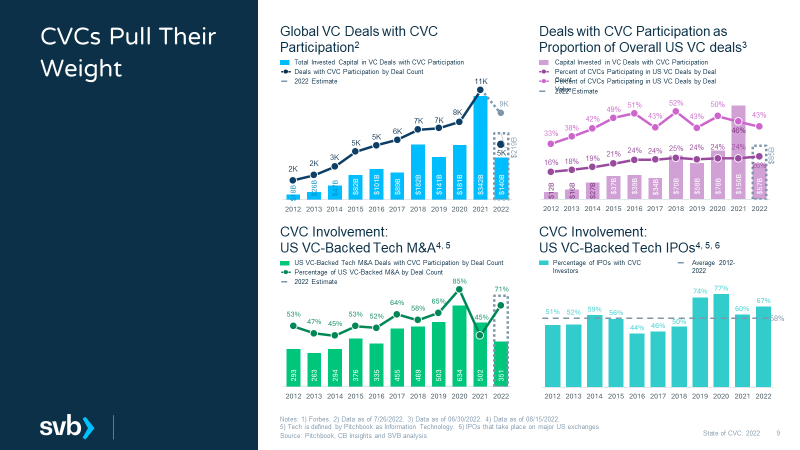

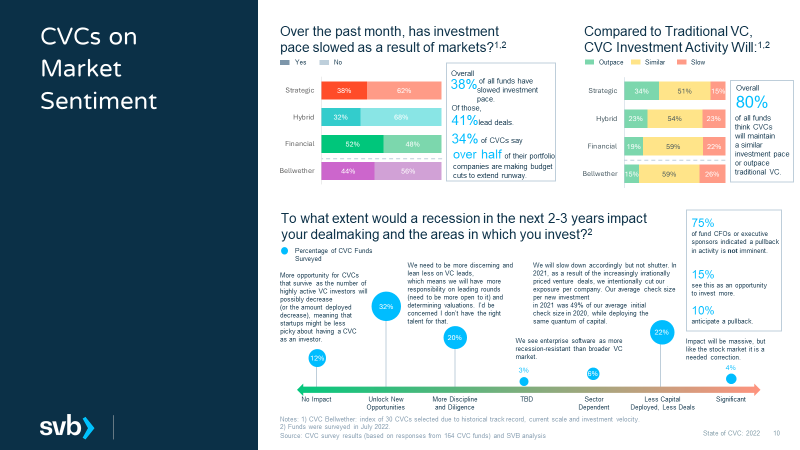

Corporate Venture Capital (CVC) is becoming a critical part of the overall investment ecosystem, making up 27% of all venture dollars invested worldwide in the globe in 2021 as reported by Silicon Valley Bank (SVB) in the State of CVC Survey. The data from this survey also shows that 80% of CVCs predict they will maintain a similar investment pace or outpace traditional VC investment.

On November 9th we hosted a gathering to learn more about the Corporate Venture Capital world and held an open discussion to help our residents understand the opportunities and offerings CVCs bring to the table.

Yvonne McCague, Managing Director at SVB, described their offerings and commitment to the innovation economy sharing information on the Banks businesses that include: Global commercial banking, Capital (investment opportunities in the innovation economy), Private banking (wealth management), and Securities/Investment banking.

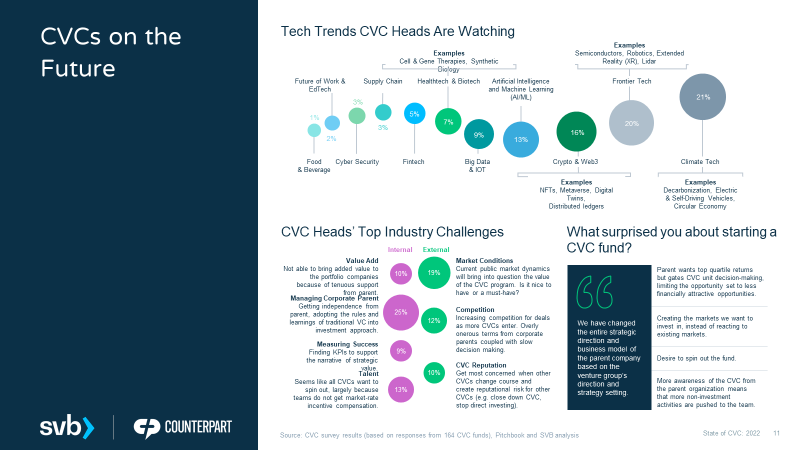

Mark Gallagher, Head of Corporate Venture Capital at SVB Financial Group, shared findings in the SVB’s 2022 State of CVC Survey and provided insights within the ecosystem. Here are 5 observations:

- CVCs push forward: 75% of CVCs said that their senior executives have not indicated that a pullback in investment activity is imminent.

- CVCs get in early: 74% of CVCs target early stage companies (defined as pre-seed, seed, Series A and Series B).

- CVCs are nimble: 58% of CVCs write a check within two months of meeting a company.

- CVCs take the lead: 66% of CVCs can lead deals and 36% of CVCs lead at least 30% of their deals. 59% can take board seats.

- CVCs are LPs: 55% of CVCs disclosed active LP positions in other venture funds. 25% of CVCs that take LP positions anticipate they will take more over time.

Additional details of Mark’s presentation are provided in the following slides:

The SVB presentation was followed by a fireside chat between Tom Ryden, MassRobotics Executive Director, and Sherwin Prior, current Director of the $1B Amazon Industrial Innovation Fund and previously Managing Director at GM Ventures. The Amazon Industrial Innovation Fund supports emerging technology companies through direct investments. It is part of Amazon’s continued commitment to invest in and foster innovation, and to enhance the employee and customer experience. The Amazon Industrial Innovation Fund provides venture capital funding to companies solving the world’s toughest problems across customer fulfillment operations, logistics, and supply chain solutions.

Conversation between Tom and Sherwin included corporate strategies, pressing challenges and opportunities, global corporate innovation, and opportunities for collaboration.

MassRobotics offers investment education events to the robotics start-up community. These events typically coincide with our demo days and provide information and tips to our start-ups prior to their engagement with many investors. These events are in person for our residents, but are open to anyone via webinar. You can watch the webinar recording here.

Thank you to Silicon Valley Bank for sponsoring this event.